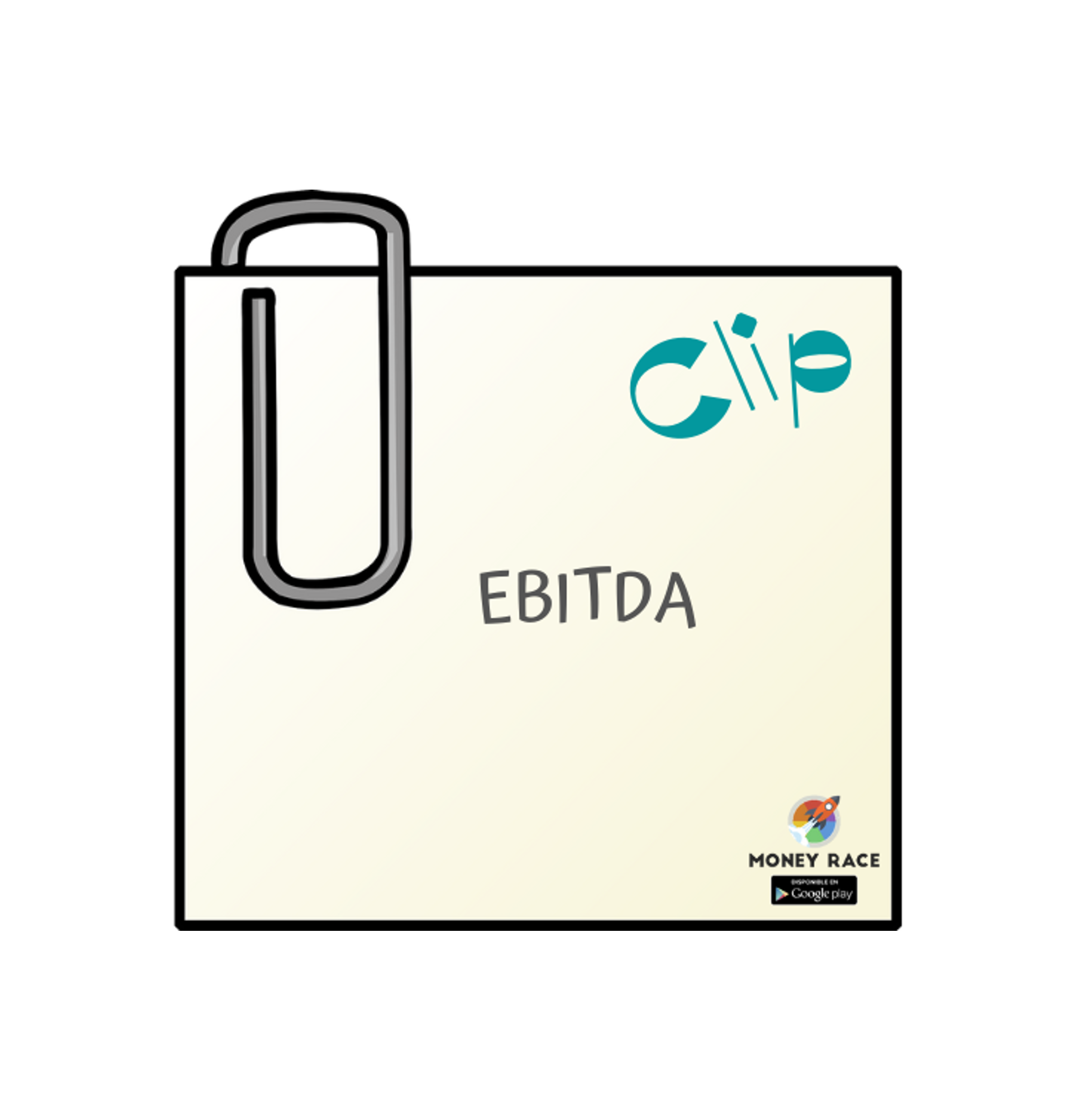

One of the most used diagrams to understand who we are and how we think is the famous money flow quadrant, designed by Robert Kiyosaki to chart the four profiles of people, according to the manner in which they mainly derive their income.

Each quadrant has its own particularities. The way you earn money will depend in which quadrant you are, which –in turn- will depend on the way you think, your interests, your educational background and your skills.

The chart is divided into four quadrants (E-S-B-I)

People located in quadrant [E] (EMPLOYEE) are those who want job security, with a good pay and benefits to offset all the time they devote to meet the financial goals of others. In this quadrant, it doesn’t matter if you’re a delivery guy or an executive officer; In both cases, the money earned is the product of a contractual relationship; That’s what matters. From a financial standpoint, this group of people depends entirely on a salary and other compensations paid by their employers. In short, people on quadrant [E] are employed.

People on quadrant [S] (SELF EMPLOYED) also want security in their financial income, but unlike employees they don’t work for others in a fixed salary, but by maintaining autonomy and control over themselves as well as the work they do and the financial compensation they expect to acquire in terms of knowledge, experience, work hours and the quality of the work they try to do. People in this quadrant focus on the product and have been proven reluctant to delegate. This group is characterized by the abundance of well-trained professionals in specific areas who work on their own (doctors, architects, painters, masons, gardeners, mechanics, dentists, commissioned salespeople, consultants, etc.). In addition to financial appreciating safety, people in this quadrant also value freedom and autonomy. In short, people on quadrant [S] are in control and own their own employment.

The third quadrant [B] (BUSINESS OWNER) corresponds to people whose profiles are opposite to that of employees. They like to delegate and expect others to be the ones who do the work that will benefit them financially. People in this quadrant have the property or have control over the business system; They strive to make the best of the people who surround them and show skills to lead people.

Unlike people from quadrant [S] who focus on the product and whose profit depends on their direct work, people who are in quadrant [B] focus on a comprehensive business system, so they don’t have the need for direct jobs for their income; thus ensuring that money keeps on entering their bank accounts, even when they’re on vacations or physically indisposed to perform some work. In short, people on quadrant [B] have a business system and hire people who will make them earn money thanks to their work.

Finally, the fourth quadrant [I] (INVESTORS) corresponds to those that focus on making money without working, making money work for them. They are people who know and are able to take risks. According to Kiyosaki, in this quadrant is where the money becomes wealth when considering that it is not measured in currency units (or money) but in the number of days that you can live without working directly and maintaining (or even increasing) your welfare and quality of life. In short, people within the quadrant [I] do not need to work directly, or hire people to do the work. Is the money that works for them.

After this quick walk through the money flow quadrant:

- In which of them do you find yourself?

- Have you decided to cross the borders of the quadrant in which you find yourself today?

- In which quadrant you want to be within 3 or 5 years?

- What are the first steps you will take to achieve it?

Finding the answers to these questions will help you make good decisions that will improve your quality of life and bring you closer to achieving your financial goals.

Your Financial Net Worth is one of the indicators that illustrate the ability to achieve financial goals for the short, medium or long term. Basically, it is the result of subtracting your liabilities worth from your assets valuation; that is to say:

Financial Net Worth = Financial Assets – Financial Liabilities

First things first:

To calculate your total Financial Assets, you must know that the most important thing to keep in mind is that your assets correspond to the physical cash you possess to purchase things either now or later. You can also consider as financial assets, those investments that can be converted into fiat money. Consumer goods, such as your clothes, TV, washing machine, furniture and fixtures (unless you’re thinking of selling them) should not be considered as financial assets because they do not contribute to putting money in your pocket.

On the other hand, generally, Financial Liabilities include all debts that you have and any other payment commitment or contractual obligation you have acquired and that involves paying in cash or handing over a financial asset. There are short and long term liabilities, enforceable and unenforceable, contingent liabilities and other, but we’ll leave that for later. For now, the important thing is that you recognize the fundamental differences between assets and financial liabilities.

A simple way to understand the difference between assets and liabilities, is assuming that an asset is anything that puts money in your pocket and a liability is anything that takes it away from you.

Each person, depending on their circumstances, interests and goals, will interpret in one way or another the value obtained by subtracting liabilities from assets; but in any case, a very good recommendation is that you calculate your Financial Net Worth now. Know how much money you have, how much you owe and how much you have left, and then act trying to eliminate the debts of major importance so that once you’ve cleaned up your finances, you begin to build a financial base that allows you to live comfortably (without strain) for at least three months.

Thus, without realizing it, you’ll be starting to get your financial freedom and you may regret not having done so before.

The key you need to gain and retain money is just a good financial education that contributes with the foundations needed for you to think and act.

Everyone wants to make money (some more than others), but if you really want to make money in the best way possible and for longer, the worst decision you can make will be to go out right now and try to find a good job hoping to stay a long time on it, because even if you find it, you will never have the certainty of getting the money you really want, and worse, if you get it, you may be unable to keep it, and then you will always depend on others. Remember that lifetime wages are long gone.

Keep in mind that it is not just to make money. The fact that you earn a lot of money today is no guarantee that you’ll have it tomorrow. What this really is about is that you retain that money, and your children and grandchildren should also benefit financially from what you’re doing today. So no matter how much money you make; the important thing is how much money you are able to keep, and for that there is no magic formulas or recipes.

The most important thing that you really need in order to earn and retain money is a financial education that will contribute to a good foundation for thinking and acting from the conviction that you are never going to achieve economic independence by having a good job nor even working on your own, literally forcing you to crush yourself hour by hour to more or less satisfy your basic needs and indulge yourself with an occasional treat. Always keep in mind that you deserve more than that.

Do you think you’re a person prepared to win and keep money? See if it’s true; try to answer this question as honestly as you can: Do you really know the difference between an asset and a liability? If your financial knowledge is what most people has, maybe you’re acquiring liabilities believing they are assets; and the worst is that without realizing it you’re building your own financial problems.

From a practical perspective, the first and most important rule to make money and keep it is to acquire assets, because as Robert Kiyosaki (author of Rich Dad Poor Dad) says, assets are those that put money in your pocket while liabilities will extract it (sometimes without you even realizing it). The difference between your assets and liabilities is your Net Worth. Until you assume this basic principle, you will find yourself with serious difficulties in making judgments and taking the best financial decisions on how to earn and keep your money.

Above all, remember that your time, your knowledge and skills are very valuable to only be exploited by others. Avoid selling your time in exchange for money; Use it rather to learn, design, build and implement a system that is able to generate money for itself.

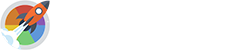

Your financial goals should be the product of your convictions, and will always be adjusted to your principles, values and priorities.

One of the first difficulties when organizing personal finances has to do precisely with setting financial goals; that is, the destination to which we are going. There are no good or bad goals; you also can’t pretend to set your financial goals by copying those that other people have imposed for themselves, far from it; financial goals vary according to your attitude, your needs, your heritage and your current financial situation.

First, before you get to work on establishing your goals, keep in mind that any goal must be expressed in numbers or percentages. If you think your goal is to have enough money saved to pay for unexpected expenses of your home and vehicle, you are not really saying anything; what is “enough” for you? How will you know if you’re getting close to the goal you set if you can not see your evolution? You should rather say: I’ll save 15% of my income as of the month of January 2016. As you can see you must not only concentrate on your desire, but also quantify what you want.

A second aspect to keep in mind is that goals are the expression of a balance between ambition and realism. It’s useless to establish poorly ambitious or easily achievable goals (eg, reduce weekly coffee spending, knowing that that’s what it costs a modest breakfast of churros with chocolate) Similarly, it is not useful to set unrealistic or difficult to reach goals (eg, to reduce by 80% the monthly utility bill for next month). In the first case, if the goal is very easy to accomplish, there would be no reason to change financial habits that contribute to achieving the medium and long term plans. In the opposite case, if you set very hard or hardly achievable goals, you will feel frustrated at not being able to reach them and in the end, dismiss the possibility of establishing new guidelines to put your finances in order. You may already have noticed that goals should involve some additional effort; In other words, your goals should require you to maintain some discipline and rigor in your daily action; therefore, that’s why you should avoid goals imposed by other people. Keep in mind that your financial goals should be the product of your conviction and consequently adjusted to your principles, values and priorities.

A third element to consider when setting your financial goals is that they can not be contradictory; all of them form part of a gearing that lets you achieve the welfare state you want. If you set a financial goal like this: save 30% of my monthly salary, and another defined in terms of: allocate 80% of my salary to reduce the outstanding balance of my credit card, which one are you going to fulfill?. Obviously both contradict each other, and at least one of them is not doable.

Finally, formulate your goals in the short, medium and long term. Don’t put them all in the same boat. For a financial objective of higher order, as might be the case: ensure financial freedom after retirement, you can set a short term goal, for example: Hiring a pension plan before the end of the fist half of 2016. You can also set a goal to medium term that contributes to achieve the same goal: for example: Acquire within the next three years, a house on the beach to rent it; and finally: A long-term goal might be: To reach retirement age without mortgage commitments and maintaining ownership of the two houses.

As you can see, setting goals is a dynamic process that requires constant review and adjustment, but the faster and at an earlier age you begin to establish your long-term goals, much better; for example, can you imagine that you start planning today how to earn income after your retirement, if you think that will happen next year? It would not make much sense, right?

If you are an investor you need to dominate the art of diversifying

Similarly as in the world of real estate, it is said that the key for a good purchase is in the location of the property, in the investment world is also considered that the place (or places) where the shares are located is the key for avoiding shocks due to market fluctuations. If you are an investor, it is very healthy to master the art of diversification, because if you combine a portfolio of well-diversified investment with a horizon of three to five years, you will be able to resist the majority of financial storms.

As we can never guarantee what will happen in the market, regardless of their condition or current characteristics, diversification is and will continue to be the rallying cry for planners, fund managers and investors. Before you decide to invest your money, you should spend time in designing an investment portfolio. Here are some tips related to diversification:

- Do not put your wealth on the same place, extend it by creating your own investment fund in companies that inspire confidence, either by the strength they show or simply because you feel comfortable when you use them in your everyday life.

- Consider including funds in the bond market. In the long term, it is healthy to incorporate this type of asset which, though less profitable, provide you some coverage against uncertainty and market volatility

- Invest regularly. Do not make the mistake of making an investment and sit and wait for the evolution of the price of those shares. Your financial “building” must be built daily, constantly putting your bricks one by one.

- Learn to sell. Investing usually associates with the purchase of a given set of shares, hoping to achieve profitability within a reasonable time; that’s fine, but you can’t put the investment in automatic mode. It is absolutely necessary that you keep up with your investment, meet the forces operating in the market and the general conditions in a given time; you must know what is happening in those companies in which you invested, so you can identify the right time to get out of that market, by selling all or part of your actions.

Even in the worst of times, investing should be a fun experience. With some knowledge, a lot of discipline and focusing on diversification, the investments you make will become a highly rewarding habit.

- ← Previous

- 1

- 2

- 3

- Next →

MONEY RACE STUDIOS 2020 - ALL RIGHTS RESERVED - LEGAL NOTICE - PRIVACY POLICY